Corporate governance statement

Overview of the Group’s Governance Approach

The Group understands the value of good corporate governance in driving the long-term sustainable success of its businesses. It is committed to high standards of governance and has evolved an approach, over many years, that it regards as appropriate, taking account of the Group’s size, structure, the complexity and breadth of its businesses and the long-term strategy it pursues in its markets across China and Southeast Asia.

An important part of strong governance is corporate stability, and this is provided by the stewardship of the business over the long-term by family, as well as related and like-minded shareholders, who hold a significant proportion of the shares of Jardine Matheson Holdings Limited (the ‘Company’), the parent company of the Group. This stability, coupled with an effective and robust corporate governance framework, supports the Board of the Company in delivering sustainable growth. It also ensures that the Group continues to demonstrate the characteristics and values that have enabled Jardines to prosper over its 193-year history. These are:

The Group believes that its stakeholders gain significant value from the long-term approach it takes. It is also important, however, to adapt to changing circumstances in our markets and, where appropriate, to the developing expectations of stakeholders and changes in best practice. In this context, over the past year the Group has strengthened the Company’s Board, and the boards and leadership teams of its portfolio companies, bringing in expertise to support our businesses in highly dynamic and competitive markets. In parallel, we have continued to enhance our approach to governance with our portfolio companies, to be more focused and to drive better decision-making and results.

In order to ensure clear allocation of accountability, we have re-emphasised that the strengthened leadership teams of our portfolio companies are responsible for creating and executing their business strategies and delivering on performance. These leadership teams are directly accountable to their respective boards, which provide robust challenge, support and guidance, bolstered by extensive industry-specific expertise and experience from independent non-executive directors (INEDs).

We provide input to our portfolio companies through our representatives on each of the respective companies’ boards, in order to help drive long-term growth and value creation, both for the relevant portfolio company and the Group as a whole.

With Jardines primarily providing strategic level input through the portfolio company boards, the Group’s central functions are also adjusting the services and support they provide to our portfolio companies, while continuing to play an active role in maintaining a strong balance sheet, protecting the Group’s reputation and preserving core Group-wide values such as integrity, steadfastness, collaboration and the importance of an entrepreneurial spirit. We will continue to support our portfolio companies, particularly where there are synergies from working together as a group of companies rather than businesses segments operating alone, in areas such as sustainability and the provision of shared services.

INEDs with a broad and diverse range of backgrounds are a valuable source of external perspectives and are a key element of good governance and decision-making. We have taken further steps over the past year to increase the independence and diversity of the Board. In this regard, Keyu Jin was appointed as an INED on 31 January 2024, and Ming Lu as an INED on 24 February 2025. In addition, Anthony Nightingale stepped down from the Board on 31 January 2024; Y.K. Pang and David Hsu retired as directors on 31 March 2024; and Percy Weatherall and Julian Hui retired as directors on 12 December 2024. As a result of these changes, the Board now comprises 9 Directors, of whom we consider 56% to be independent, taking into account the independence considerations under the UK Corporate Governance Code (the ‘Code’), and 22% are female.

The Company’s Audit Committee comprises solely directors whom we consider as independent, with Stuart Gulliver as the independent Chair of the Committee, supported by Janine Feng and Michael Wu.

Group Structure

The Board and senior management are concerned both with the direct management of the Company’s own activities and with engagement with our portfolio companies, through Jardines representatives on their boards. By establishing common values and standards and sharing experience, contacts and business relationships, we optimise opportunities across the markets in which we operate.

The Group has developed this approach over time and it is designed so that portfolio companies benefit from the Group’s professional expertise, while at the same time ensuring that the independence of their boards is respected and clear operational accountability rests with their executive management teams. We believe this approach is a key element of the Group’s success.

Key changes to governance of our portfolio companies

Since the beginning of 2024, as part of our continued efforts to enhance Group governance, changes were announced in respect of several portfolio companies: Hongkong Land Holdings Limited (HKLH), DFI Retail Group Holdings Limited (DFIRGH), Mandarin Oriental International Limited (MOIL) and Jardine Cycle & Carriage Limited (JC&C). These governance changes, which include a number of important appointments made to boards and management teams, build on strong foundations to increase the effectiveness of decision-making and support long-term growth and value creation.

Board changes

The following changes were made to the boards of the relevant portfolio companies:

INED appointments

- Elaine Chang joined the DFIRGH board as an INED in February 2025, bringing over 30 years of experience across multiple geographies and industries, including semiconductors, hardware devices, digital content, e-commerce, cloud computing, and AI.

- Ming Mei joined the HKLH board as an INED in October 2024, bringing extensive functional and industry expertise and experience in the Chinese mainland market, including as co-founder and CEO of GLP, a leading global business owner, developer and operator of logistics real estate, data centres, renewable energy and related technologies.

- MOIL appointed three new INEDs in 2024, to support its refreshed strategy as a brand-led, guest-centric, global luxury hospitality group:

- - Fabrice Megarbane joined the board in August 2024. Fabrice has many years’ experience in marketing and luxury brands across multiple markets, having worked for L’Oréal since 2000;

- - Cristina Diezhandino was appointed a director in August 2024. She brings expertise in marketing, innovation and digital transformation, including 18 years working in senior roles at Diageo; and

- - Scott Woroch joined the board in November 2024. Scott has more than 30 years’ experience in the luxury hospitality sector, including 15 years with Four Seasons, and brings particular expertise in relation to hotel development.

- Mikkel Larsen joined the JC&C board as an INED in January 2024. He unexpectedly passed away on 23 January 2025.

- Jean-Pierre Felenbok joined the JC&C board as an INED in April 2024. Mr Felenbok is an experienced corporate adviser who has spent many years operating in Southeast Asia across a wide range of industries.

Other board changes

- John Witt was appointed Chair of the board of DFIRGH in July 2024;

- Adam Keswick stepped down from the board of DFIRGH in July 2024;

- Ben Keswick stepped down from the board of DFIRGH in February 2025;

- Graham Baker was appointed to the board of DFIRGH in July 2024;

- John Witt was appointed Chair of the board of HKLH in October 2024, succeeding Ben Keswick, who stepped down from the Board;

- John Witt stepped down from the board of MOIL in July 2024;

- John Witt was appointed Chair of the board of JC&C in August 2024, succeeding Ben Keswick, who stepped down as a director of JC&C; and

- Stephen Gore stepped down from the board of JC&C in February 2025.

Jardines representatives on portfolio company boards

We provide input to portfolio companies through Jardines representatives on their boards. The Jardines representatives on each board are shown in the table below:

| Listed portfolio companies | Jardines representatives |

| HKLH |

|

| DFIRGH |

|

| MOIL |

|

| Astra (Board of Commissioners) |

|

| JC&C |

|

The changes to the boards of our portfolio companies have been accompanied by a focus on strengthening the independence and effectiveness of the board committees of each of our listed portfolio companies. INEDs have been appointed to the remuneration and nomination committees of each of HKLH, DFIRGH and MOIL, and the terms of reference of each committee have been updated to support their ongoing effective operation. Over the past year, each of HKLH, DFIRGH and MOIL has appointed INEDs as chairs of their respective audit committees, and the audit committees of each of DFIRGH and MOIL now have a majority of INEDs as members.

Management changes

The leadership of our portfolio companies has been strengthened with the appointment of Michael Smith as Chief Executive of HKLH in April 2024, which followed the appointment of Scott Price as Chief Executive of DFIRGH in August 2023 and Laurent Kleitman as Chief Executive of MOIL in September 2023.

Each of these new CEOs has established executive teams with deep industry expertise and experience, and each of these businesses is adapting its approach to address rapidly-changing market conditions. The focus of each company is on implementing new strategies, endorsed by their respective boards, with a clear vision for the future of their sectors and how to navigate the uncertain and complex environment in which they operate. This will be critical to building strong and sustainable businesses.

In addition to the executive management changes in our listed portfolio companies, we have also appointed Elton Chan as CEO of our privately-held Jardine Pacific group of companies. Elton is leading a strategic review of the Jardine Pacific portfolio of businesses, to set a new direction for the future, taking account of the market conditions relevant to each of those businesses.

Governance and legal framework

The Company is incorporated in Bermuda. The primary listing of the Company’s equity shares is in the Equity Shares (Transition) Category (the ‘Transition Category’) of the Main Market of the London Stock Exchange (the ‘LSE’). The Company also has secondary listings in Singapore and Bermuda. As the Company has only secondary listings on these exchanges, many of the listing rules of such exchanges are not applicable. Instead, the Company must release the same information in Singapore and Bermuda as it is required to release under the rules which apply to it as a result of being listed in the Transition Category on the LSE.

As a company incorporated in Bermuda, the Company is governed by:

- the Bermuda Companies Act 1981 (the ‘Bermuda Companies Act’);

- the Bermuda Jardine Matheson Holdings Limited Consolidation and Amendment Act 1988 (as amended, the ‘Special Act’), pursuant to which the Company was incorporated, and the Bermuda Jardine Matheson Holdings Limited Regulations of 1993 (as amended, the ‘Regulations’) were implemented; and

- the Company’s Memorandum of Association and Bye-Laws.

The Bermuda Takeover Code for the Company is set out in the Regulations and is based on the UK City Code on Takeovers and Mergers. It provides an orderly framework within which takeover offers can be conducted and the interests of shareholders protected.

Other acquisition mechanisms available under the Bermuda Companies Act include schemes of arrangement and amalgamation and mergers. The Bermuda Companies Act provides a framework within which such procedures can be conducted and the interests of shareholders protected.

The shareholders can amend the Company’s Bye-Laws by way of a special resolution at a general meeting of the Company.

The Company’s listing in the Transition Category of the LSE means that it is bound by many, but not all, of the same rules as companies which fall within the Equity Shares (Commercial Companies) categories (the ‘Commercial Companies Category’) of the LSE, under the UK Listing Rules (as defined below), the Disclosure Guidance and Transparency Rules (the ‘DTRs’) issued by the Financial Conduct Authority of the United Kingdom (the ‘FCA’), the UK Market Abuse Regulation (‘MAR’) and the Prospectus Regulation Rules. This includes rules relating to continuous disclosure, periodic financial reporting, disclosure of interests in shares, market abuse and the publication and content of prospectuses in connection with admission to trading or the offering of securities to the public. In addition, the Company is subject to regulatory oversight from the FCA, as the Company’s principal securities regulator, and is required to comply with the Admission and Disclosure Standards of the Main Market of the LSE.

The Company and its directors are also subject to legislation and regulations in Singapore relating, among other things, to insider dealing.

The Company is not required to comply with the Code, which applies to all UK Commercial Companies Category issuers and sets out the governance principles and provisions expected to be followed by companies subject to the Code. However, the Company does have regard to the Code in developing and implementing its approach to corporate governance and disclosure.

When the shareholders approved the Company’s move to a standard listing from a premium listing in 2014, the Company stated that it intended voluntarily to maintain certain governance principles, which were applicable to it at that time by virtue of its premium listing. As a result, the Company adopted a number of governance principles (the ‘Governance Principles’) based on the applicable requirements for a UK premium listing in 2014, which went further than the standard listing requirements at the time.

The FCA recently reformed the UK listing regime, introducing new UK Listing Rules which came into effect on 29 July 2024 (the ‘UK Listing Rules’), replacing the previous UK premium and standard segments of the Main Market of the LSE with the Commercial Companies Category. As a result of these reforms, the listing of the Company’s equity shares was transferred to the new Transition Category.

Following these changes, the Company has undertaken a review of the Governance Principles, to ensure they remain appropriate and take into account market practice. Following this review, the Board considers that, while the Company continues to have no obligation to comply with the more onerous requirements imposed by its voluntary application of the Governance Principles, it is appropriate to retain them, subject to certain amendments which are appropriate to align more closely with, and have regard to, the UK Listing Rules to which other UK listed companies are subject.

Going forward, the Company intends to have regard to the UK Listing Rules (as in effect on 29 July 2024) applicable to the Commercial Companies Category, when applying the Governance Principles in relation to significant transactions and related party transactions. This means that the key elements of the Governance Principles are now updated as follows:

- If the Company carries out a related party transaction which would require a sponsor to provide a fair and reasonable opinion under the provisions of the UK Listing Rules, it will engage an independent financial adviser to confirm that the terms of the transaction are fair and reasonable as far as the shareholders of the Company are concerned.

- If the Company carries out such a related party transaction or a significant transaction (one that would be classified as a significant transaction under the provisions of the UK Listing Rules), as soon as reasonably practical after the terms are agreed, the Company will issue an announcement, providing such details of the transaction as are necessary for investors to evaluate the effect of the transaction on the Company.

- At each annual general meeting, the Company will seek shareholders’ approval to issue new shares on a non-pre-emptive basis for up to 33% of the Company’s issued share capital, of which up to 5% can be issued for cash consideration.

- The Company adheres to a set of Securities Dealing Rules which follow the provisions of MAR with respect to market abuse and disclosure of interests in shares.

The Management of the Group

Board

The Board is responsible for ensuring that the Group is appropriately managed and achieves its strategic objectives in a way that is supported by the right culture, values and behaviours. The Group’s culture provides the foundation for the delivery of our strategy and our long-term, sustainable success. Our workforce policies and practices are consistent with and support our culture. Periodic colleague surveys are conducted to assess the culture and enable management to identify actions that could be taken to further improve our culture.

The Board is also responsible for ensuring that appropriate systems and controls are in place to enable efficient management and well-informed decision-making. Our business processes incorporate efficient internal reporting, robust internal controls, and supervision of current and emerging risk themes, all of which form a vital part of our governance framework. As a key part of this, the Group Corporate Secretary has set up processes and systems to ensure that all Directors receive information in a timely, accurate and clear manner. We use a board paper distribution portal to disseminate board and committee papers securely to Directors.

The Executive Chairman facilitates discussions at Board meetings, by ensuring all Directors have an opportunity to make comments and ask questions. In addition, the Executive Chairman discusses matters with Directors individually and collectively outside of Board meetings. The Executive Chairman also uses other gatherings of the Directors, such as Board dinners, to facilitate discussions in a less formal environment.

The Board has full power to manage the Company’s business affairs, except matters reserved to be exercised by the Company in a general meeting under Bermuda legislation or the Company’s Bye-Laws. Key matters that the Board is responsible for include:

- the overall strategic aims and objectives of the Group;

- establishing the Company’s purpose and values;

- approval of the Group’s strategy and risk appetite to align with the Group’s purpose and values;

- approval and oversight of the Group policy framework and approval of appropriate Group policies;

- approval of the Annual Budget and monitoring of performance against it;

- oversight of the Group’s activities;

- approval of major changes to the Group’s corporate or capital structure;

- approval of major capital expenditure and significant transactions in terms of size or reputational impact;

- approval of interim and final financial statements, and Annual Report and Accounts, upon recommendation from the Audit Committee, as well as interim management statements;

- approval of dividend policy and the amount and form of interim and final dividend payments, for approval by shareholders as required;

- ensuring relevant sustainability and ESG matters are incorporated into purpose, governance, strategy, decision-making and risk management, and approving the annual Sustainability Report issued by the Group;

- overseeing the management of risk within the Group;

- any significant changes to the Company’s accounting policies or practices, upon recommendation from the Audit Committee;

- appointment, re-appointment or removal of the external auditor, subject to shareholders’ approval, upon recommendation from the Audit Committee;

- approval of matters relating to AGM resolutions and shareholder documentation;

- approval of all shareholder circulars, prospectuses and listing particulars issued by the Company; and

- approval of material public announcements concerning matters decided by the Board.

Responsibility for certain matters, including the approval of borrowing facilities and capital expenditure (other than major capital expenditure required to be approved by the Board), has been delegated by the Board to executive management.

Board activity

Set out below is a summary of the key areas of activity of the Board:

1. Strategy

To facilitate oversight and provide opportunities for the Board to challenge and measure progress against the Group’s strategic priorities, at each Board meeting the Group Managing Director, supported by other members of executive management, provides an update on the operational and financial performance of each portfolio company. In addition, the Board regularly conducts ‘deep dives’ on one or more portfolio companies, to provide more comprehensive insights into the progress of the relevant business against strategy.

2. Financial performance and risk

The Board oversees the actions the Company takes to deliver superior, long-term returns for our shareholders from our portfolio of market-leading businesses. We aim for decisive portfolio management built on a disciplined, long-term approach to capital allocation and investment expertise, to maximise financial performance, maintain our financial strength and manage risk. Over time, we have developed deep relationships with a wide range of well- capitalised, leading banks and corporate partners, which support the Group’s financial strength.

Our approach is underpinned by the Company and its portfolio companies always seeking to maintain a strong balance sheet and liquidity position. This has enabled the Group to move with confidence in making some of our most substantial acquisitions at times of market dislocation.

The Group Finance Director presents a detailed overview of the financial performance of the Group at each Board meeting, to ensure that Directors are provided with sufficient information to enable them to provide appropriate financial oversight, and have the opportunity to challenge management as appropriate. The information provided includes details of the financial performance of each portfolio company.

The Board also reviews the Group’s capital allocation approach, dividend policy and shareholder returns, as well as the management of Group debt levels, interest cover and capital markets activities.

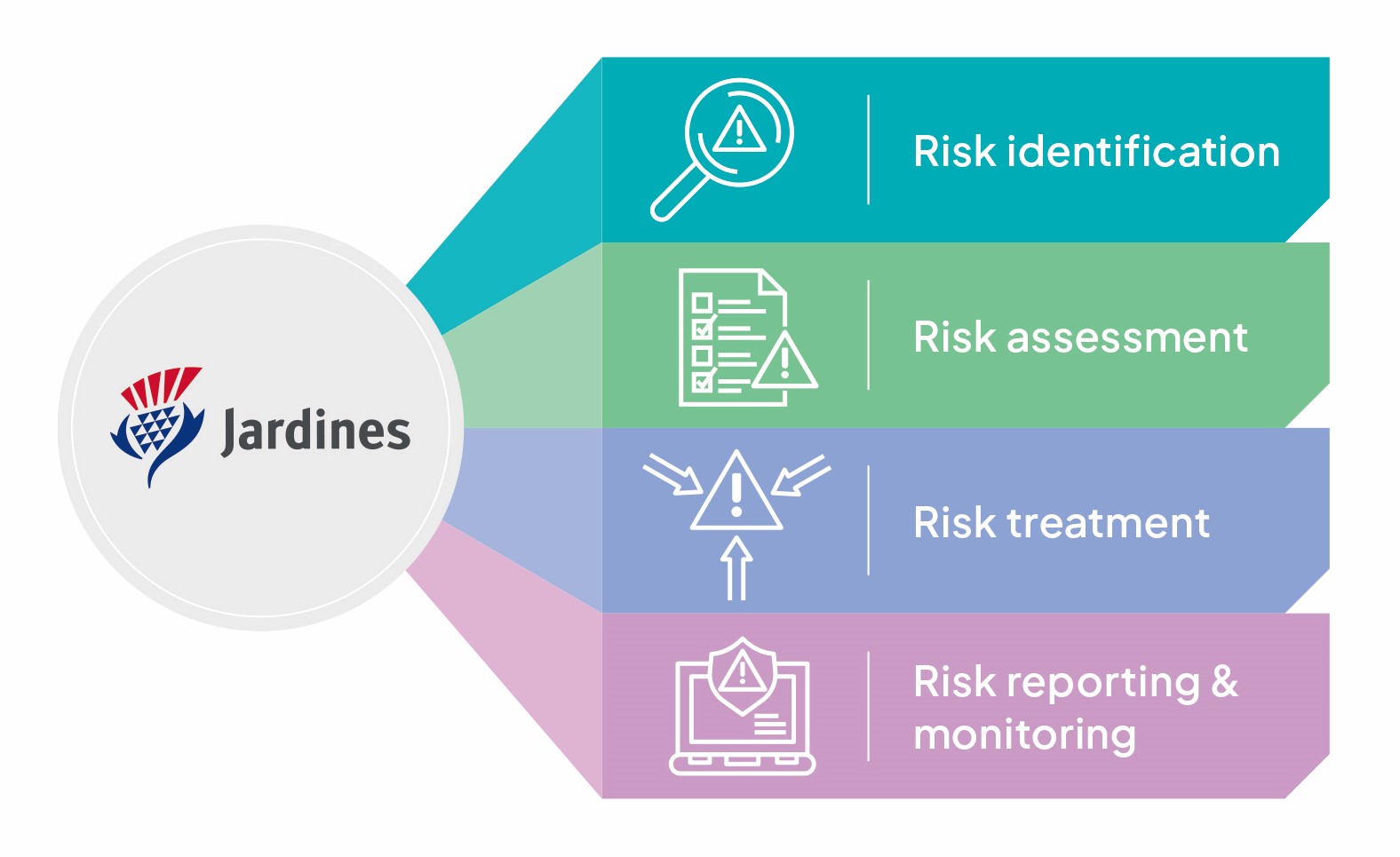

The Board has overall responsibility for risk management and is actively engaged in regular discussions about the principal risks faced by the Group. The Audit Committee, on behalf of the Board, undertakes an annual assessment of the effectiveness of the management of the principal risks facing the Group and actions taken to mitigate them, validating the key risks and approving any necessary actions arising from the risk assessments. This process takes into account the key risks faced, and the risk management approach taken, by each of the portfolio companies.

Maintaining and enhancing the risk and internal control environment is fundamental to the Group’s governance framework and the Board’s stewardship of the Company.

3. Operational Performance

At each Board meeting, an update is provided on the operational performance of each portfolio company, which offers important insights into the opportunities and challenges faced. In addition, Directors are provided with a deeper understanding of how our varied markets function and the implications for stakeholder-related issues, in order to equip the Board with the necessary perspective to enhance strategic decision-making.

4. Supporting leadership teams and colleagues

The Group attaches great importance to attracting, developing and retaining leadership talent at the Group level, as well as supporting the management teams in our portfolio companies to do the same for their businesses.

The Group and our portfolio companies are focused on enhancing performance management structures to recognise, reward and retain talent, with incentives aligned to drive shareholder value by building better, stronger businesses.

The Company and each of our portfolio companies are also committed to creating an inclusive workplace which reflects the diversity of the communities we serve.

The Board is provided with regular people updates to enable it to support talent attraction, development and retention, and the progress of Inclusion, Equity and Diversity (IE&D) and colleague engagement initiatives.

5. Governance and stakeholder engagement

We ensure that highly-qualified boards and CEOs are in place across the Group’s portfolio companies, with clear accountability for strategy and operational delivery. The Company drives delivery and performance through Jardines representation on those boards.

A range of governance matters are discussed at Board meetings, including directors’ and officers’ insurance, litigation, regulatory changes, review and approval of statutory reporting and shareholder documentation and governance-related matters.

The Group Finance Director and the Group General Counsel provide Directors with regular updates on stakeholder engagement – including engagement with shareholders, governments, civil society and other relevant third parties – and relevant regulatory developments. Increasing the Directors’ understanding of stakeholder views and priorities, and the actions being taken by the Group to address them, supports the Board’s decision-making.

Updates from the Group Finance Director provide the Board with feedback on investor views and expectations, visibility of market conditions, share price performance, shareholder returns and the future outlook.

The Group General Counsel and the Group Head of Corporate Affairs and Sustainability provide the Board with Sustainability updates twice a year, which include the progress being made by the Group and portfolio companies in progressing sustainability priorities, including achieving climate action objectives, particularly in relation to decarbonisation, as well as updates on responsible consumption and social inclusion initiatives.

The Audit Committee Chair provides an update on the activities of the Audit Committee at the Board meeting immediately following each Audit Committee meeting.

Board Composition

The Board’s composition and the way it operates provide stability, allowing us to take a long-term view as we seek to grow our business and pursue investment opportunities.

As at 10 March 2025, the Board comprised nine Directors, five of whom (56%) – Janine Feng, Keyu Jin, Stuart Gulliver, Ming Lu and Michael Wu – we consider as independent, taking into account the relevant considerations under the Code.

There were a number of Board changes during the year: Anthony Nightingale stepped down from the Board on 31 January 2024; David Hsu and Y.K. Pang retired from the Board on 31 March 2024; and Julian Hui and Percy Weatherall retired from the Board on 12 December 2024. There are detailed plans in place to ensure orderly succession for the Board.

In recent years, the Board has increased its gender diversity with the appointment of two female INEDs (22% of the Board). More information on the actions the Group is taking in relation to diversity and inclusion can be found in the IE&D section of this Report on page 84.

The names of all the Directors and brief biographies appear on pages 66 to 68 of this Report.

Ben Keswick has been Executive Chairman of the Board since 15 June 2020, and John Witt has held the role of Group Managing Director since that date.

The Board has considered the diversity of the Company’s Board and senior executives in the context of the requirements under the UK Listing Rules that UK listed companies should publish information on the gender and ethnic representation of their Board and executive management. As at 31 December 2024, being the reference date for the purposes of 22.2.30R(1)(a) of the UK Listing Rules which require the disclosure of certain diversity statistics, and as shown below:

- The Board met its target of having one Director from a minority ethnic background;

- The Company does not currently meet the target of the Board comprising at least 40% female directors, but will continue to take IE&D considerations into account for future Board appointments; and

- The Board does not currently meet the target to have a female director occupying one of the senior Board positions (chair, chief executive or chief financial officer). The Directors who hold these roles were appointed following formal, rigorous and transparent nomination procedures and are the most suitable and experienced individuals for their roles and the Group’s needs. The Board will continue to take IE&D considerations into account for future appointments for these roles.

The Company did not meet the targets under the UK Listing Rules of the Board comprising at least 40% female directors, and having one of the senior Board positions occupied by a female director, due to the significant change to the composition of the Board and executive management which would be required to meet these requirements.

The Company has taken substantive steps in the past year to increase the diversity of the Board. A second female INED was appointed in January 2024. The Company will continue to take IE&D considerations into account with respect to future appointments of directors and executive management positions.

The table below, which follows the format and categories prescribed by the UK Listing Rules, illustrates the ethnic background and gender diversity of the Board and executive management – which includes the Group Corporate Secretary, but excludes administrative or support staff – pursuant to 22.2.30R(2) of the UK Listing Rules, as at 31 December 2024, which is our chosen reference date in accordance with the UK Listing Rules1.

|

As at 31 December 2024 |

Number of board members2 |

Percentage of the board1,2 |

Number of senior positions on the board (CEO, CFO, SID and Chair)1 |

Number in executive management (JML Board and Group Corporate Secretary) |

Percentage of executive management (JML Board and Group Corporate Secretary) |

|

|

|

|

|

|

|

|

Gender diversity |

|

|

|

|

|

|

Men |

6 |

75% |

3 |

7 |

100% |

|

Women |

2 |

25% |

– |

– |

– |

|

Not specified/prefer not to say |

– |

– |

– |

– |

– |

|

|

|

|

|

|

|

|

Ethnic diversity |

|

|

|

|

|

|

White British or other White |

|

|

|

|

|

|

(including minority-white groups) |

5 |

63% |

3 |

5 |

71% |

|

Mixed/Multiple Ethnic Groups |

– |

– |

– |

– |

– |

|

Asian/Asian British |

3 |

38% |

– |

2 |

29% |

|

Black/African/Caribbean/Black British |

– |

– |

– |

– |

– |

|

Other ethnic group |

– |

– |

– |

– |

– |

|

Not specified/ prefer not to say |

– |

– |

– |

– |

– |

|

Note: 2 Number of board members and board gender and ethnic diversity percentages have changed following the appointment of Ming Lu to the Board of the Company on 24 February 2025. |

|||||

The Company has a Board Diversity Policy. We refer to this policy when making appointments to the Audit Committee, but we do not have a separate Diversity Policy for the Audit Committee. IE&D considerations are, and will be, taken into account where relevant to Board and Audit Committee appointments.

Board composition as at 10 March 2025:

The Board considers that there is a clear division of responsibilities between the Executive Chairman and the Group Managing Director, and this ensures an appropriate balance of power and authority.

Executive Chairman

The Executive Chairman’s role is to lead the Board, ensuring its effectiveness while taking account of the interests of the Company’s various stakeholders, and promoting high standards of corporate governance.

The Executive Chairman’s principal responsibilities are in the areas of strategy, external relationships, governance and people. The Executive Chairman leads the Board in overseeing the long-term strategic direction of the Group and approving its key business priorities. His key responsibilities also include:

- building an effective Board supported by a strong governance framework;

- supporting the Group Managing Director in the execution of his duties;

- ensuring a culture of openness and transparency at Board meetings;

- chairing Board meetings effectively, ensuring all Directors effectively contribute to discussions;

- ensuring comprehensive committee reporting to the Board;

- ensuring all Directors receive accurate, timely and clear information;

- communicating with Directors on a regular basis between Board meetings and promoting effective communication between executive Directors (‘Executive Directors’) and Non-Executive Directors;

- ensuring that all Non-Executive Directors have a comprehensive induction programme and an ongoing programme to build their knowledge and understanding of the business;

- providing feedback to Non-Executive Directors on their performance and attendance at meetings;

- leading succession planning for the Group Managing Director;

- leading, with the Group Managing Director, the development of the culture and values of the Group;

- agreeing, together with the Group Managing Director, key business priorities;

- supporting the development and maintenance of relationships with existing and new key business partners, governments and shareholders; and

- ensuring, with the Group Managing Director, an appropriate focus on attracting and retaining the right people and carrying out succession planning for executive management positions.

Group Managing Director

The Group Managing Director is responsible for developing the Group’s strategy for approval by the Board and ensuring its timely execution, as well as managing all aspects of the performance and management of the Company, with day-to-day responsibility for:

- effective management of the Company;

- leading the development of the Group’s strategic direction and implementing the strategy approved by the Board;

- overseeing the Group’s approach to capital allocation, business planning and performance;

- identifying and executing new business opportunities;

- managing the Group’s risk profile and implementing and maintaining an effective framework of internal controls;

- developing targets and goals for his executive team;

- leading, with the Executive Chairman, the development of the culture and values of the Group;

- ensuring effective communication with shareholders and key stakeholders and regularly updating institutional investors on the business strategy and performance;

- providing regular updates to the Board on portfolio performance;

- ensuring, together with the Executive Chairman, an appropriate focus on attracting and retaining the right people and carrying out succession planning for executive management positions; and

- fostering innovation and entrepreneurialism to support the growth of the Group’s businesses.

INEDs

The INEDs bring insight and relevant experience to the Board. They have responsibility for constructively challenging the strategies proposed by the Executive Directors and scrutinising the performance of management in achieving agreed goals and objectives. In addition, INEDs work on individual initiatives, as appropriate.

Board Meetings

The Board usually holds four scheduled meetings each year, as well as ad hoc meetings when appropriate to deal with urgent matters that arise between scheduled meetings. Board meetings are usually held in different locations around the Group’s markets.

The Board receives high-quality, up-to-date information in advance of each meeting, which is provided to Directors via a secure online board information portal. The Company reviews the information provided to the Board regularly, to ensure that it remains relevant to the needs of the Board in carrying out its duties.

The Directors who are based outside Asia visit the region regularly to review and discuss the Group’s businesses. The knowledge these Directors have of the Group’s affairs, as well as their experience of the wider Group, provides significant value to the ongoing review by the Company of the Group’s performance and reinforces the Board oversight process.

Board Attendance

Directors are expected to attend all Board meetings. The table below shows the attendance at the scheduled 2024 Board meetings:

| Meetings eligible to attend | % attended | |

|

Current Directors |

|

|

| Executive Directors |

|

|

| Ben Keswick | 4/4 |

100% |

| John Witt | 4/4 |

100% |

| Graham Baker | 4/4 |

100% |

| Adam Keswick | 4/4 |

100% |

| Non-Executive Directors | ||

| Janine Feng | 3/4 | 75% |

| Stuart Gulliver | 4/4 | 100% |

| Keyu Jin | 4/4 | 100% |

| Michael Wu | 4/4 | 100% |

| Former Director | ||

| Percy Weatherall(1) | 4/4 | 100% |

| Julian Hui(1) | 4/4 | 100% |

| David Hsu(2) | 1/1 | 100% |

| Y.K. Pang(2) | 0/1 | 0 |

| Anthony Nightingale(3) | – | – |

Notes:

(1) Percy Weatherall and Julian Hui retired from the Board of the Company with effect from 12 December 2024.

(2) David Hsu and Y.K. Pang retired from the Board of the Company with effect from 31 March 2024.

(3) Anthony Nightingale retired from the Board of the Company with effect from 31 January 2024.

Appointment and Retirement of Directors

There are detailed plans in place to ensure orderly succession for the Board. The Board is focused on development and succession plans at both Board and executive level, to strengthen the management pipeline. The Executive Chairman, in conjunction with other Directors, reviews the size, composition, tenure and skills of the Board. The Executive Chairman leads the process for new appointments, monitors Board succession planning, and considers independence, diversity, inclusion and Group governance matters, as well as relevant expertise and experience, when recommending appointments to the Board. Non-Executive Directors are appointed on merit, against objective criteria, and are initially appointed for a three-year term.

Upon appointment, all new Directors receive a comprehensive induction programme over several months. This is designed to facilitate their understanding of the business and is tailored to their individual needs. The Group General Counsel and the Group Corporate Secretary are responsible for providing a briefing that covers our core purpose and values, strategy, key areas of the business and corporate governance.

Prior to appointment, the Executive Chairman assesses the commitments of a proposed candidate, including other directorships, to ensure they have sufficient time to devote to the role. The Executive Chairman also regularly assesses the time commitments of Directors, to ensure that they each continue to have sufficient time for their role. He also considers the potential additional time required in the event of urgent corporate events. Any Director external appointments, which may affect existing time commitments relevant to the Board, must be agreed with the Executive Chairman in advance.

In accordance with the Company’s Bye-Laws, each new Director is subject to retirement and re-appointment at the first annual general meeting after their appointment. Directors are then subject to retirement by rotation requirements under the Bye-Laws, whereby one-third of the Directors retire at the annual general meeting each year. These provisions apply to both Executive Directors and Non-Executive Directors, but the requirement to retire by rotation does not extend to the Executive Chairman or Group Managing Director.

The Company has determined that it is appropriate for the Executive Chairman and the Group Managing Director to be exempt from the retirement by rotation requirements. An important part of the Group’s strong governance is corporate stability, which is provided by the stewardship over the long term of the business by family, as well as related and like-minded shareholders, who hold a significant proportion of the shares of the Company. The Group Managing Director is appointed by the Executive Chairman. The Group believes that its stakeholders gain significant value from the long-standing governance approach the Group has taken.

In accordance with Bye-law 84, Stuart Gulliver and Michael Wu will retire by rotation at the forthcoming Annual General Meeting and, being eligible, offer themselves for re-election. In accordance with Bye-law 91, Ming Lu will also retire at the forthcoming Annual General Meeting and, being eligible, offer himself for re-election. None of Stuart Gulliver, Michael Wu or Ming Lu has service contracts with the Company or its subsidiaries.

Director training

The Board and Audit Committee are provided with regular training sessions on subjects of topical relevance or matters which would support the effective functioning or effectiveness of the respective board and/or committee. During the year, the Board received training relating to the development of the Group’s key markets.

Financial and reporting systems

Each of the portfolio companies is responsible for its operational performance and the implementation of its strategy. The Company has established policies and procedures for financial planning and budgeting, information and reporting systems, risk management and monitoring of operations and performance. The information systems in place are designed to ensure that the financial information reported is reliable and up to date.

The Group’s key management team, whose names appear on page 69 of this Report, meet regularly in Hong Kong.

Corporate Secretary

All Directors have access to advice and support from the Group Corporate Secretary, who is responsible for advising the Board on all governance matters.

Insurance and Indemnification

The Company purchases insurance to cover its Directors against their costs in defending themselves in civil proceedings taken against them in that capacity, as well as in respect of damages resulting from the unsuccessful defence of any proceedings. To the extent permitted by law, the Company also indemnifies its Directors. Neither insurance nor indemnity arrangements, however, provide cover where the Director has acted fraudulently or dishonestly.

Delegations of Authority

The Group has an organisational structure with defined lines of responsibility and appropriate delegations of authority in place.

The Group’s delegation of authority framework establishes a clear pathway for decision-making. This ensures that judgments are made at the correct business level by those team members most equipped to do so. Every decision made aligns with the Group’s culture and values, taking into account the advantages, risks, financial consequences, and effects on all stakeholders. The Board, supported by the Audit Committee, places significant emphasis on maintaining high governance standards throughout the Group. This focus assists the Board in accomplishing its strategic goals and fulfilling key performance objectives.

Directors’ Responsibilities in Respect of the Financial Statements

Under the Bermuda Companies Act 1981, the Directors are required to prepare financial statements for each financial year and present them annually to the Company’s shareholders at the annual general meeting. The financial statements are required to present fairly, in accordance with International Financial Reporting Standards (IFRS), the financial position of the Group at the end of the year, and the results of its operations and its cash flows for the year then ended. The Directors consider that applicable accounting policies under IFRS, applied on a consistent basis and supported by prudent and reasonable judgments and estimates, have been followed in preparing the financial statements. The financial statements have been prepared on a going concern basis.

Substantial Shareholders

As a non-UK issuer, the Company is subject to the provisions of the DTRs, which require that a person must, in certain circumstances, notify the Company of the percentage of voting rights attaching to the share capital of the Company that person holds. The obligation to notify arises if that person acquires or disposes of shares in the Company and that results in the percentage of voting rights which the person holds reaching, exceeding, or falling below, 5%, 10%, 15%, 20%, 25%, 30%, 50% and 75%.

The Company has been informed of the following holdings of voting rights of 5% or more attaching to the Company’s issued ordinary share capital:

| Shareholders | No. of ordinary shares | Percentage of voting rights |

| Butterfield Trust (Bermuda) Limited | 41,824,585 | 14.34 |

| 1947 Trust (as defined below) | 37,645,791 | 12.91 |

| First Eagle Investment Management, LLC | 14,714,540 | 5.05 |

| Allan & Gill Gray Foundation | 14,598,476 | 5.01 |

Apart from these interests and the interests disclosed under Directors’ Share Interests’ below, the Company is not aware of any holders of voting rights of 5% or more attaching to the issued ordinary share capital of the Company as at 10 March 2025.

There were no contracts of significance with corporate substantial shareholders during the year under review.

Related Party Transactions

Details of transactions with related parties entered into by the Company during the course of the year are included in note 37 to the financial statements on page 185.

Engagement with shareholders, other stakeholders and colleagues

We engage regularly with our stakeholders, including our employees, investors, creditors, partners and government, and this enables us to understand their perspectives and ensures we address their expectations and shape our actions accordingly.

The Group regularly engages with its shareholders. Since the beginning of 2024, two results briefings and a number of analyst and institutional shareholder meetings have been held, to enable shareholders to ask questions of executive management, discuss concerns and hear feedback on areas where improvements could be made. The Group has responded to feedback from institutional shareholders in a number of areas, including by increasing the independence and diversity of the Board.

The Group also regularly engages with its workforce. Both the Company and portfolio companies regularly conduct engagement surveys to hear from colleagues, with response rates ranging from 75% to 98%, on a par with, or in some cases higher than, most global benchmarks. Engagement surveys are anonymous and provide colleagues with the ability to raise issues, suggest improvements and give feedback on their experience of working for the Company and portfolio companies.

We take the results of such surveys seriously and, in 2024, held three senior management workshops to discuss and address the results from engagement, culture and inclusive leadership surveys conducted in the fourth quarter of 2023. Action plans have been developed to address feedback and improve our colleagues’ engagement at various levels of the organisation, and planned actions are being implemented, both on a near- and longer-term basis.

The Group and many of its portfolio companies also carry out shorter pulse surveys on a periodic basis to track the progress of engagement. The results of surveys suggest that culture is increasingly aligned with purpose, values and strategy and that workforce policies and practices are consistent with values and support long-term success.

The Group also engages with internal and external stakeholders to communicate the progress it is making in respect of its sustainability approach and seek feedback. This includes regular discussions with shareholders. More information can be found in the Stakeholder Engagement and Materiality Assessment section of the Group’s Sustainability Report. The 2023 Sustainability Report is accessible via the corporate website www.jardines.com, and the 2024 Sustainability Report will be published later this year.

Securities Purchase Arrangements

The Directors have the power, under the Bermuda Companies Act and the Company’s Bye-Laws, to purchase the Company’s shares. Any shares so purchased are required to be treated as cancelled and, therefore, reduce the Company’s issued share capital. The Board regularly considers the possibility of share repurchases or the acquisition of further shares in its portfolio companies. When doing so, it considers the potential for enhancing earnings or asset values per share. When purchasing such shares, the Company is subject to the provisions of MAR.

During the year ended 31 December 2024, the Company repurchased and cancelled 2,661,700 ordinary shares for an aggregate total cost of US$101 million. The ordinary shares, which were repurchased in the market, represented approximately 0.9% of the Company’s issued ordinary share capital.

Annual General Meeting

The Company’s 2025 Annual General Meeting will be held on 2 May 2025. The full text of the resolutions and explanatory notes in respect of the meeting are contained in the Notice of Meeting that is published at the same time as this Report and can be found at www.jardines.com/en/investors/shareholder-centre/annual-general-meeting.

Corporate Website

The Company’s corporate website, which contains a wide range of additional information of interest to investors, can be found at www.jardines.com.

Group Policies

Code of Conduct

The Group conducts business in a professional, ethical and even-handed manner. Its standards are clearly set out in its Code of Conduct, a set of guidelines to which every employee must adhere and which is reinforced and monitored by a regular training and compliance certification process. The Code of Conduct requires that all portfolio companies and employees comply with all laws of general application, all rules and regulations that are industry-specific and proper standards of business conduct. In addition, the Code of Conduct prohibits the giving or receiving of illicit payments. It requires that all managers be fully aware of their obligations under the Code of Conduct and establish procedures to ensure compliance at all levels within their businesses.

In 2022, the Code of Conduct was updated to make it easier to understand, more impactful, and more relevant to the modern workplace. All employees are expected to familiarise themselves with the refreshed Code of Conduct and to be the person of integrity that the Code of Conduct envisages. During the year, annual training on the refreshed Code of Conduct was rolled out to staff. Each of the portfolio companies either applies the Code of Conduct or has implemented its own code of conduct, which is aligned to the Code of Conduct but tailored to its particular industry, business or circumstances.

The Company’s policy on commercial conduct underpins internal control processes, particularly in the area of compliance. The policy is set out in the Code of Conduct.

The Code of Conduct can be viewed on the Company’s website at www.jardines.com/en/about-us/corporate-governance.

Whistleblowing

The Company has a whistleblowing policy covering how employees can report matters of serious concern. The Board has the responsibility for overseeing the effectiveness of the formal procedures for colleagues to raise such matters and is required to review any reports made under those procedures referred to it by the internal audit function. The Board routinely reviews the effectiveness of the whistleblowing arrangements and reporting.

The Company has a confidential whistleblowing service, managed by an independent third party, which supplements existing whistleblowing channels in the business units to assist employees in raising matters of concern and reporting cases of suspected illegal or unethical behaviour. The service, which aims to help foster an inclusive, safe and caring workplace, is available 24 hours a day in multiple local languages and is accessible through several channels. Colleagues may make anonymous submissions in situations where it is inappropriate or not possible to report a matter of concern to a manager or supervisor, or a Group People & Culture (P&C) or Group Legal representative.

Reports may be lodged by one of three channels: email, website or telephone hotline. Each report is allocated a unique case number which enables follow-up with the reporter, if appropriate. Once a report is lodged, it is sent to certain authorised persons at the relevant business unit. These include senior representatives from legal, compliance and P&C teams who have experience in dealing with such matters. The authorised persons will follow up on the report and investigate where necessary. The reporter will be notified of the outcome.

Each of the portfolio companies has implemented a whistleblowing service, which is tailored to its particular industry, business or circumstances.

All reports are treated confidentially, and no retaliation against a person reporting a matter of concern in good faith will be tolerated.

Inclusion, equity & diversity (IE&D)

Jardines is a diversified Group with investments in a wide range of market-leading businesses across Asia and other regions. With a diversified portfolio of companies across Asia, we understand that our greatest asset is our people. Their diverse talent, experiences, and backgrounds drive our growth. We are committed to fostering an environment that values every individual, ensuring every voice contributes to our collective success.

Our people represent many ideas, experiences, cultures and backgrounds. The Group’s diversity is one of our key strengths, and our employees all have a part to play in ensuring that our workplace supports and encourages inclusion and collaboration.

The Group applies the principle that colleagues should always treat others in a way they would expect others to treat them. Bullying, intimidation, discrimination, and harassment of others have no place in the Group and will not be tolerated.

Our IE&D Policy, which can be viewed at www.jardines.com/en/about-us/corporate-governance, encapsulates these principles and states that all employees, regardless of ethnicity, gender, age, sexual orientation, disability, background or religion, should be treated fairly and with dignity, be given equal opportunities and be valued for the contributions they make in their role.

We value the physical and mental health, safety and well-being of our employees, and this is key to the success of our Group. All staff are encouraged and supported to develop their full potential and contribute to the sustainable growth of the Group. Colleagues’ views and ideas are important, and they are encouraged to express them respectfully at all levels within the organisation.

In November 2023, we conducted a culture and inclusive leadership survey. The survey was anonymous to ensure colleagues’ psychological safety in providing feedback. To address the survey findings, a series of Inclusive Leadership Workshops were hosted in 2024 across the Group. Colleagues of all seniority levels, ranging from senior leaders to general staff, participated in these workshops. The workshops provided participants with practical tips and takeaways for building an inclusive workplace. New initiatives were also launched to improve our inclusive culture. A pulse survey was conducted in February 2025 to measure the progress made from the culture and inclusive leadership survey conducted in 2023.

The Company keeps the composition of its Board and executive management team under ongoing review, to ensure that it remains appropriate to face the challenges of the changing business landscape. The Company is actively focused on supporting increased gender diversity in the Company and each of the portfolio companies. We have developed targets for increasing female representation in our leadership, but recognise that further progress needs to be made to achieve our objectives.

To build an inclusive workplace which helps progress our ambitions across the Group, we incorporate IE&D principles across our business and P&C practices. This includes:

- Ongoing collaboration to ensure a set of inclusive working arrangements and policies to support IE&D;

- Keeping our recruitment, promotion, and retention systems fair and based on aptitude, merit, and ability, including ongoing reviews of remuneration to ensure appropriateness of pay levels;

- Active talent management and career support for our talent pools, to provide equitable opportunities that will enable a diverse future pipeline of leaders; and

- Cultivating the right set of leadership behaviours through learning campaigns to ensure our people behave in a way consistent with the principles we have put in place.

The Group has a dedicated IE&D team, which leads initiatives driving IE&D in the workplace. The team also works closely with the IE&D community across our portfolio companies. Through regular knowledge and resource sharing, we promote an open and inclusive culture where everyone can succeed.

Data Privacy

The Group’s Code of Conduct and Data Breach Notification Policy underpin this commitment.

The Group is committed to being a responsible custodian of the data entrusted to it by customers, employees, suppliers and other stakeholders keeping the data secure and processing it in accordance with legal requirements and stakeholder expectations as they continue to evolve.

Remuneration Report

Introduction

This Report sets out the approach to remuneration for the Company’s Directors and employees. It summarises the link between our values, strategy and our remuneration framework, and between performance and reward, in determining remuneration outcomes.

Remuneration Philosophy and Reward Framework

Jardine Matheson aims to provide a remuneration framework which is appropriate and supports our strategy, creating value for stakeholders and having regard to the core principles and integrity standard set out in the Code of Conduct.

We aim to ensure that our compensation system is designed in a manner that reflects our culture and strategic priorities. Our remuneration framework serves to attract, motivate and retain colleagues at all levels, while aligning the interests of colleagues and shareholders and taking account of stakeholder expectations, as appropriate. Our rewards approach is to reward all individuals competitively, fairly and free from gender, race, ethnicity, age, disability and other non-performance- related considerations.

We achieve this approach through applying the key principle that total compensation should be competitive with the market. Market competitiveness is assessed by benchmarking against a predetermined target market positioning for comparable jobs on total compensation, including base salary, allowances and short-term incentives.

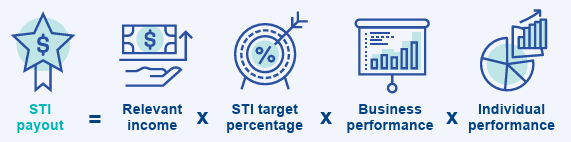

The table below summarises the elements of our remuneration approach and their application:

| Element | Basis of determination |

|

Base salary |

Base salary is determined considering market competitiveness and internal relativity with reference to the scope and complexity of the role, geographical location, and relevant professional experience required. |

|

Short-term incentive |

Short-term incentives are designed to incentivise and reward the achievement of business objectives, individual performance and contribution, and more specifically:

|

|

Benefits and allowances |

Benefits are designed to ensure market competitiveness and relevance to our employees through flexible options. Benefits are fully compliant with local regulations. |

|

Long-term incentives |

For Executive Directors and members of the executive management team, a significant part (up to 30%) of the amounts paid to them as annual distributions is required to be used to acquire shares in the Company (which they must retain for as long as they are employed by the Group and for an additional two years thereafter), thus constituting an effective long-term incentive. More detail is provided on page 89. |

How Remuneration is Linked to Business Strategy

Jardine Matheson’s approach to remuneration is designed to support and reinforce its strategic priorities. The level of remuneration is determined based on a review of the contribution to the achievement of these priorities. In particular, the level of contribution to and achievement of:

| Priorities | Measurement Period |

| Key strategic objectives and evolving our portfolio | Long-term (>3 years) |

| Driving operational excellence | Short-term (≤3 years) |

| Enhancing leadership and entrepreneurialism | Short-term |

| Progressing sustainability | Short- and long-term |

These priorities are reviewed regularly to ensure alignment with the Company’s strategic direction. Each year, the Executive Chairman and Group Managing Director, in consultation with members of the Board, then agree annual objectives to advance these priorities. The annual objectives for 2024 are summarised below:

| Objective | Measure of success |

| Ensure refreshed value creation strategies in place at relevant portfolio companies |

|

| Strengthen succession planning and incentive alignment |

|

| Deliver Group performance | The Group:

|

| Drive Groupwide sustainability agenda |

|

| Continue non-core asset disposals |

|

At the beginning of each year, each senior executive sets out individual performance objectives that are relevant to their role. These objectives are required to take account of the role’s expected contribution to the Company and be aligned with the Company’s strategic direction and annual objectives, as well as Company culture. These individual objectives are then agreed between the senior executive and the Group Managing Director, in consultation with the Executive Chairman, and the senior executive is held accountable for the agreed objectives. By assigning goals on an annual basis and reviewing them regularly, we ensure relevance to and alignment with the Group’s strategic direction, as well as alignment between the interests of senior executives and shareholders.

Objectives are determined in a manner that allows the Company to achieve its strategic ambitions, while delivering competitive remuneration upon their achievement.

Each year, senior executive achievements are reviewed and compensation levels are approved. Communication of remuneration- linked goals and attainment is designed to be simple in nature, so it is easy to understand for participants, and it can clearly show direct alignment to the strategic priorities of the Company.

Directors’ Remuneration

Shareholders decide in general meetings the Directors’ fees which are payable to the Executive Chairman and all Non-Executive Directors, as provided for by the Company’s Bye-Laws.

The remuneration of the Company’s Non-Executive Directors is not linked to performance. This is consistent with Non- Executive Directors being responsible for objective and independent oversight of the Group. The Company’s Bye-Laws provide that Non-Executive Directors may determine their own remuneration, but the total amount provided to all Directors (not including the Group Managing Director and any other Executive Directors3 of the Company) must not exceed the sum agreed by shareholders at a general meeting. The maximum aggregate remuneration of US$1.5 million per annum was approved by shareholders at the 2022 AGM, and the Company is seeking a renewal of shareholder approval for this total sum at the 2025 AGM.

Non-Executive Directors do not receive bonuses or any other incentive payments or retirement benefits. The Non-Executive Directors are reimbursed for expenses properly incurred in performing their duties as a Director of the Company.

The level of fees paid to the Company’s Non-Executive Directors is kept under regular review. Fees are benchmarked against a peer group of similar companies and a proposal is reviewed by the Board every two years.

The schedule of fees paid to Directors in respect of 2024 is set out in the table below. Fees are annual fees, unless otherwise stated:

| US$ | |

| Base Non-Executive Director fee | 100,000 |

| Audit Committee Member fee |

35,000 |

| Audit Committee Chairman fee |

50,000 |

| Director | Director fee US$ |

Audit Committee fee US$ |

Total fees US$ |

|

| 1 | Ben Keswick (Executive Chairman) | - | N/A | - |

| 2 | John Witt | - | N/A | - |

| 3 | Adam Keswick | - | N/A | - |

| 4 | Graham Baker | - | N/A | - |

| 5 | Janine Feng | 100,000 | 35,000 | 135,000 |

| 6 | Stuart Gulliver | 100,000 | 50,000 | 150,500 |

| 7 | Michael Wu | 100,000 | 35,000 | 135,000 |

| 8 | Keyu Jin(1) | 100,000 | N/A | 100,000 |

| Former directors | ||||

| Anthony Nightingale(2) | 8,470 | 2,965 | 11,435 | |

| Y.K. Pang(3) | - | N/A | - | |

| David Hsu(3) | 24,864 | N/A | 24,864 | |

| Julian Hui(4) | 100,000 | N/A | 100,000 | |

| Percy Weatherall(4) | 100,000 | N/A | 100,000 | |

| Total | 633,334 | 122,965 | 756,299 |

Notes:

(1) Keyu Jin was appointed to the Board of the Company with effect from 31 January 2024.

(2) Anthony Nightingale retired from the Board of the Company with effect from 31 January 2024.

(3) Y.K. Pang and David Hsu retired from the Board of the Company on 31 March 2024.

(4) Julian Hui and Percy Weatherall retired from the Board of the Company on 12 December 2024.

(5) Ming Lu was appointed to the Board of the Company with effect from 24 February 2025. He did not receive any director’s fee in 2024 and will receive US$100,000 director’s fee in 2025.

3 For the purposes of this section entitled ‘Directors’ remuneration’ and the following section entitled ‘Share ownership by Executive Directors’, Executive Directors means the Executive Directors of the Company and members of the executive management team, as listed from pages 66 to 69.

The Executive Directors are paid a basic fixed salary by, and receive certain employee benefits from, the Group.

The Executive Directors’ performance is assessed by reference to: (i) the overall contribution by each Executive Director to increasing shareholder value over the long-term, by reference to long-term sustainable growth in earnings per share, focusing on underlying earnings per share, a progressive dividend policy and the share price as well as the achievement of agreed Group objectives; and (ii) performance by reference to agreed individual objectives.

Depending on their performance, the Executive Directors may receive amounts in lieu of discretionary annual incentive bonuses from the income of a trust created in 1947 (the ‘1947 Trust’), which holds 37,645,791 ordinary shares in the Company, representing 12.9% of the Company’s issued share capital.4. The Executive Directors do not receive any discretionary annual incentive bonuses from the Group.

This arrangement benefits shareholders by aligning their interests with those of the Executive Directors. This happens in two principal ways.

First, the 1947 Trust was established and acts completely independently of the Company. Decisions as to the allocation of the 1947 Trust’s income to the Executive Directors are made by the Executive Chairman, taking into account the interests of shareholders as a whole, in consultation with the Group Managing Director and an INED, and with the benefit of appropriate external advice as and when appropriate. The fact that this assessment and these decisions are made by a significant shareholder, taking into account the interests of shareholders as a whole, and not the Company, is a key benefit for shareholders of this arrangement.

Secondly, a significant part (up to 30%) of the amounts paid to Executive Directors from the 1947 Trust is specified to be for the purposes of acquiring shares in the Company. Executive Directors are expected to acquire shares in the Company up to the relevant value within a six-month period after the payment and then retain such shares in accordance with the share ownership policy, described in the section entitled ‘Share Ownership by Executive Directors’ below.

The 1947 Trust’s income consists solely of ordinary dividends it receives on its shareholding in the Company. Those dividends are accounted for by the Company as ordinary dividends and the amounts paid to the Executive Directors are not borne by the Group or accounted for as expenses of the Group. This also directly benefits shareholders.

Share Ownership by Executive Directors

We believe that it is essential to align the interests of shareholders and Executive Directors. This means creating an environment where the Executive Directors are incentivised to create long-term shareholder value. We have sought to do this in part by requiring all Executive Directors to accumulate and hold shares in the Company for the long-term.

In this regard, the Company has adopted a Directors’ Shareholding Policy (the ‘Policy’). The Policy requires that each of the Executive Directors should build a meaningful and increasing shareholding in the Company over time.

The Policy sets a minimum shareholding requirement. For all Executive Directors (other than the Executive Chairman and the Group Managing Director) the minimum requirement is to hold shares in the Company with a value of 2.5 times their annual basic salary. For the Executive Chairman and the Group Managing Director, the value is five times their annual basic salary. New Executive Directors are permitted two years from the commencement of their employment to accumulate the required level of shareholding.

Notwithstanding these minimum shareholding requirements, the fact that a significant part of the amounts awarded to Executive Directors by the 1947 Trust (as described above) is specified to be for the purposes of acquiring shares in the Company means that the minimum levels will generally be exceeded for each Executive Director within a relatively short period after the commencement of their employment. Current shareholdings of the Executive Directors are set out below.

All shares, once acquired, should be retained by the relevant Executive Director for so long as they are engaged by the Group and for at least two years thereafter.

As and when any Executive Director ceases to hold any office or be employed by the Company or any member of the Group, the Executive Chairman will discuss with the relevant individual how the Policy will apply in their circumstances. However, as noted above, it is expected that former Executive Directors will retain all shares held at the cessation of their engagement with the Group for at least two years thereafter.

Remuneration outcomes in 2024

For the year ended 31 December 2024, the Company’s Directors received US$47.9 million (2023: US$53.6 million) in aggregate, being:

| 2024 US$m |

2023 US$m |

|

| Distributions from the 1947 Trust | 40.3 | 45.2 |

| Directors’ fees and employee benefits from the Group | 7.6 | 8.4 |

Directors’ fees and employee benefits included:

| 2024 US$m |

2023 US$m |

|

| Directors’ fees | 0.8 | 0.8 |

| Short-term employee benefits including salary, bonuses, accommodation and deemed benefits in kind |

6.6 | 7.2 |

| Post-employment benefits | 0.2 | 0.4 |

The information set out in this section headed ‘Remuneration Outcomes in 2024’ forms part of the audited financial statements.

Consistent with the Company’s remuneration philosophy, discretionary compensation for Executive Directors was set based on assessment of performance in 2024. This assessment was made by reference to their overall contribution toward advancing strategic priorities as well as the achievement of specific annual and individual performance objectives (as further described in the ‘How Remuneration is Linked to Business Strategy’ section).

Directors’ Share Interests

The Directors of the Company and Jardine Matheson Limited in office on 10 March 2025 had interests* in the ordinary share capital of the Company as set out below. These interests included those notified to the Company in respect of the Directors’ closely associated persons*.

| Jardine Matheson Holdings Limited | Interests |

| Ben Keswick | 52,129,889(a) (b) |

| John Witt | 411,811 |

| Graham Baker | 94,652 |

| Stuart Gulliver | 59,180 |

| Adam Keswick | 44,662,266(a) (b) |

| Notes: (a) Includes 1,750,004 ordinary shares held by a family trust, the trustees of which are closely associated persons of Ben Keswick and Adam Keswick. (b) Includes 39,064,738 ordinary shares held by family trusts, the trustee of which is a closely associated person of Ben Keswick and Adam Keswick. |

*within the meaning of MAR

| Jardine Matheson Limited | Interests |

| Matthew Bland | 64,384 |

| Stephen Gore | 58,000 |

| Steve Sun | 14,467 |

In addition to the interests of the Directors of the Company and JML set out above, the interests for each of the Executive Directors include 37,645,791 ordinary shares in the Company held by the 1947 Trust, in which the Executive Directors are interested as discretionary objects under the 1947 Trust (as further described in the ‘Directors’ Remuneration’ section) and/or as the 1947 Trust is a closely associated person of certain of the Directors. For these purposes, such Executive Directors are deemed to be interested in the 37,645,791 ordinary shares held by the 1947 Trust.

In addition, as at 10 March 2025, Ben Keswick, John Witt, Adam Keswick, Stephen Gore and Elton Chan held options in respect of 120,000, 50,000, 50,000, 35,000 and 10,000 ordinary shares, respectively, issued in the past pursuant to the Company’s share-based long-term incentive plans.

Share schemes

In the past, share-based long-term incentive plans provided incentives for Executive Directors and senior managers.

No options have been granted since 2019, and there are no current plans to grant further options. Share options are not granted to Non-Executive Directors.

Audit Committee Report

Chair’s introduction

I am pleased to present the Audit Committee’s report for the year ended 31 December 2024. As part of the continuing focus on evolving the Company’s governance, we increased the number of Audit Committee meetings each year to three in 2024, with the extra meeting held in December. The third Audit Committee meeting focused on providing the Company with an early warning for issues that might impact the full-year results.

The challenging macro environment has been an area of focus for the Audit Committee this year, with close attention paid to the non-cash impairments in Hongkong Land’s Build-to- sell business on the Chinese mainland in the first half, in addition to first-half headwinds faced by a number of our portfolio companies, including lower new car sales margins at Zhongsheng and commodity prices at Astra.

The Audit Committee has regularly scrutinised key accounting issues and judgements made by management, to monitor andassess the continued integrity of the Company’s financial reporting. Read more in note 44 to the financial statements.

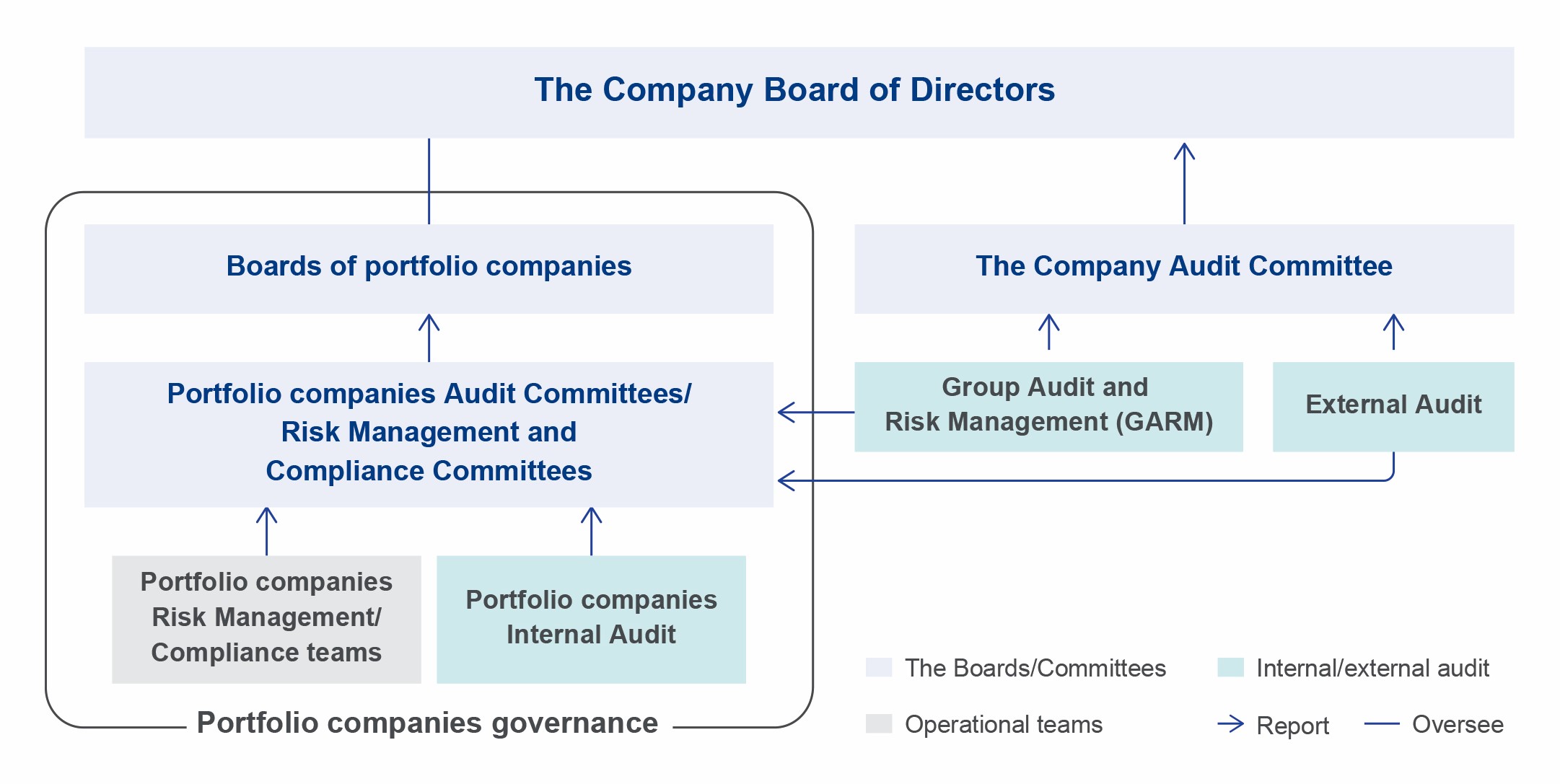

The Audit Committee has monitored the approach and scope of the Company’s non-financial reporting framework, taking into account evolving environmental, social and governance reporting. It also receives regular updates from management on the wider control environment, such as the controls in place for financial reporting, and examines the progress being made in remediating any deficiencies, with input from the Group’s Audit and Risk Management function (GARM) and our external auditor, PricewaterhouseCoopers (PwC).

The Audit Committee reviewed and monitored the Company’s principal risks through a combination of business reviews, focused engagements, and regular updates from management, GARM, and PwC. Read more on page 93.

The Audit Committee’s role is to monitor the effectiveness of the Company’s financial reporting, including ESG and climate- related financial disclosures, systems of internal control, and risk management. The Audit Committee also monitors the integrity of the Company’s external and internal audit processes.

The Audit Committee’s key responsibilities are summarised in its terms of reference on page 92, and the full terms of reference can be obtained from the Company’s website at www.jardines.com.

Stuart Gulliver

Audit Committee

The Board is supported by the activities of the Audit Committee. Matters considered by the Committee are set out in its terms of reference, a copy of which can be obtained from the Company’s website at www.jardines.com.

The current members of the Audit Committee are:

- Stuart Gulliver (Chairman);

- Janine Feng; and

- Michael Wu.